“The scandal is what’s legal, not what’s illegal.”

– Former Justice Department prosecutor Tarek Helou on the hurdles to bringing PPP fraud cases

“The federal government is swamped with reports of potential fraud in the Paycheck Protection Program, according to government officials and public data, casting a shadow on one of Washington’s signature responses to the coronavirus pandemic.”

“About $525 billion in loans were distributed to 5.2 million companies between April 3 and Aug. 8.”

“Banks and the government allowed companies to self-certify that they needed the funds, with little vetting.”

“The Small Business Administration’s inspector general, an arm of the agency that administers the PPP, said last month there were “strong indicators of widespread potential abuse and fraud in the PPP.”

“Tens of thousands of companies received PPP loans for which they appear to have been ineligible, such as corporations created after the pandemic began, businesses that exceeded workforce size limits (generally 500 employees or fewer) or those listed in a federal “Do Not Pay” database because they already owe money to taxpayers.”

“Tens of thousands of organizations also appear to have received more money than they should have based on their headcounts and compensation rates.”

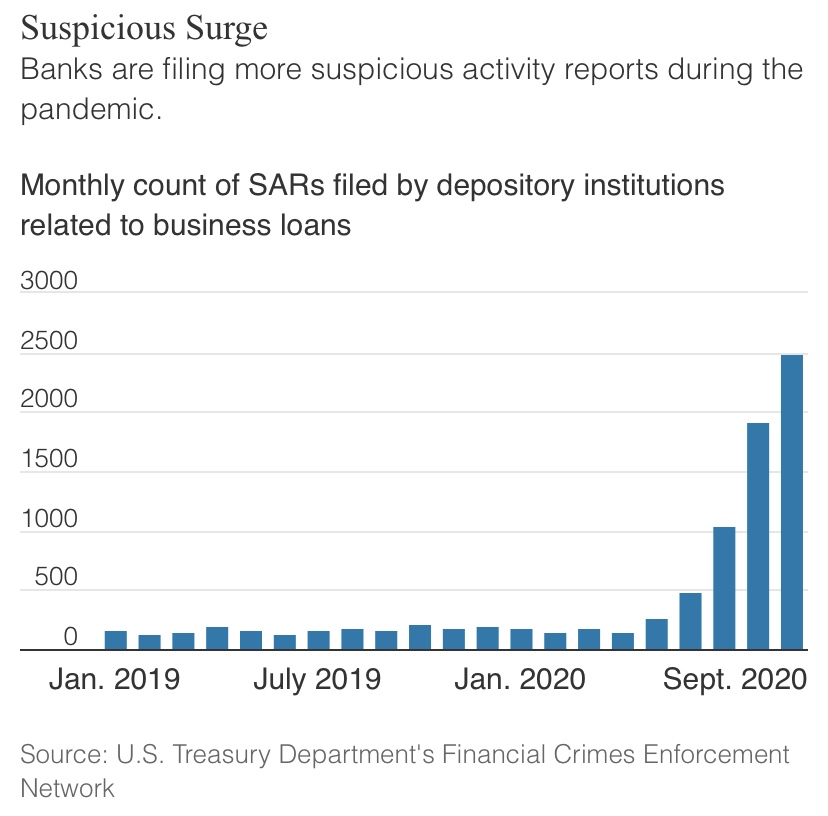

“The Treasury Department in September received 2,495 suspicious activity-reports involving business loans from banks and other depository institutions, more than the total for any year dating back to 2014.”

“Several hundred PPP-related investigations have been opened, involving nearly 500 suspects and hundreds of millions of dollars of loans, according to the Federal Bureau of Investigation.”

“The Justice Department has charged 73 defendants in PPP-related fraud cases, a spokesman said late last month. Many involve allegations of made-up companies or forged documents.”

“The CARES Act, the March law that established the PPP, effectively used the honor system. If a company had fewer than 500 employees and certified “current economic uncertainty makes this loan request necessary to support the ongoing operations,” it was generally approved.”

“At the PPP’s peak, the SBA approved about 514,000 loans on a single day, May 3.”

“Researchers at the Massachusetts Institute of Technology in July compared payroll data at PPP-eligible companies to ineligible ones and estimated the program had boosted employment by about 2.3 million jobs. At that rate, the PPP would have cost about $224,000 per job supported.”

“It seems that a lot of that cash went to businesses that would have otherwise maintained relatively similar employment levels,” said David Autor, an MIT economics professor and one of the study’s authors.”

(https://www.wsj.com/articles/ppp-was-a-fraudster-free-for-all-investigators-say-11604832072)